does idaho have capital gains tax

To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. The capital gains rate for Idaho is.

What Are Capital Gains Tax On Home Sale In Dallas

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and.

. 208 334-7660 or 800 972-7660 Fax. Does idaho have capital gains tax on. The percentage is between 16 and 78 depending.

Object Moved This document may be found here. The Idaho Income Tax. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

County tax rates range throughout the state. Unlike your primary residence you will. Your average tax rate is 1198 and your marginal tax rate is 22.

Wages salaries 100000 Capital gains - losses -50000. Uppermost capital gains tax rates by state 2015 State State uppermost rate. The rates listed below are for 2022 which are taxes youll file in 2023.

Idaho does not levy an inheritance tax or an estate tax. Right off the bat if you are single they will allow you to exclude 250000 of capital gains. A homeowner with a property in.

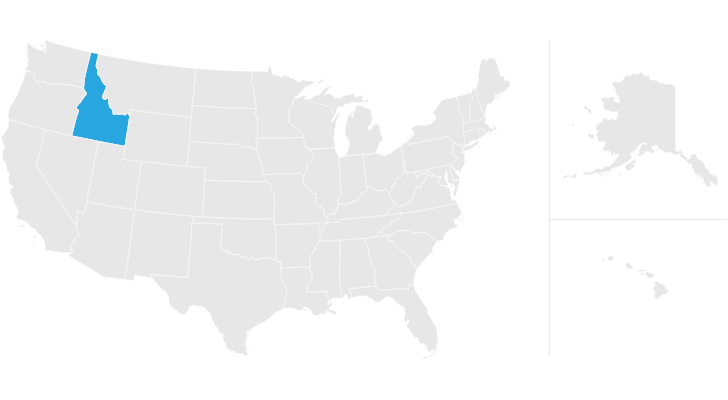

State Tax Commission PO. The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. An individual will be exempted from paying any tax if their annual income is below a predetermined limit.

A majority of US. How does state of Idaho treat the capital gain tax on foreign property sale. The District of Columbia moved in the.

Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. Idaho Income Tax Calculator 2021. One important thing to know about Idaho income taxes.

States have an additional capital gains tax rate between 29 and 133. Idaho State Tax Commission. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. 5 days ago Jun 30 2022 Florida does not have state or local capital gains taxes. The Combined Rate accounts for the Federal capital.

Does Idaho have an Inheritance Tax or an Estate Tax. In brief based on the following the capital gains on the foreign property would be treated the. Residential Indians between 60 to 80 years of age will be exempted.

Historical Idaho Tax Policy Information Ballotpedia

Form Cg Idaho Capital Gains Deduction

Passive Investing In Idaho Real Estate With Heather Dreves Capital Gains Tax Solutions

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Idaho Income Tax Calculator Smartasset

2022 Capital Gains Tax Rates By State Smartasset

Gubernatorial Candidate Dave Reilly From Idaho Declares He Would Abolish Property Capital Gains And Income Tax For Idahoans Who Use Bitcoin R Bitcoin

How High Are Capital Gains Taxes In Your State Tax Foundation

Idaho Estate Tax Everything You Need To Know Smartasset

2021 Capital Gains Tax Rates By State

Capital Gains Tax Rates By State Nas Investment Solutions

Idaho Tax Forms And Instructions For 2021 Form 40

Crypto Capital Gains And Tax Rates 2022

Capital Gains Tax Calculator 1031 Crowdfunding

State Taxes On Capital Gains Center On Budget And Policy Priorities

The States With The Highest Capital Gains Tax Rates The Motley Fool